18 Mar 2025

Drive to Survive vs Trade to Survive?

Daily thoughts

Trade recap

What I’m reading

Markets overview

Portfolio review

I’ve recently started watching Netflix’s Drive to Surve. Yes I’m very late to the party, I’m only at Season 2. I love the parallels between racing and investing though.

First, the mentality required to succeed in both is very similar. Competitiveness and a hunger to win, continuous improvement and outworking the competition, taking winning and losing very personally. You see the best drivers and team principals tying their identities and self-worth to winning. That’s the same for the best performing investors - Druckenmiller, Cohen, Soros and others. They’re highly competitive, they hate losing, and they wouldn’t know what else to do if not investing/trading.

Second, they’re both about optimising for things you can control, yet the outcome can vary significantly due to unforeseen circumstances. In a race, you can have the best car, the best drivers, but if another car crashes into your driver, or if someone in your pit team fails to change a tire properly, you can easily go from P1 to P20. Just like with your portfolio - you can optimise with the best R/R trades with good IRRs, but names can go against you for a while and make it seem like your formula (no pun intended) isn’t working.

Last, winning once is not enough - you need to keep winning, every year. The record resets at the start of every season and you need to prove yourself again. Being the best requires putting in the work every day, every year. If you have a good team (portfolio), and consistently improve your car and shave seconds off your laps (optimise your portfolio), and keep racing your best (make good trades with no avoidable mistakes), you will have a good chance of being on top, and staying on top.

Made 4 trades yesterday, let’s recap:

Long KWEB 0.00%↑ bull call spread

I got this idea from options flow. A big fish bought 27,500 contracts of May call spreads at 41/48 so I’m following suit.

Fundamentally, I’m also bullish on China in the near-term given its plans to revitalise domestic consumption.

Long GLD 0.00%↑ bull call spread

Also from options flow. Got in May 282/295 call spreads.

More of a hedging position. I’m still bullish on risk assets, so hard to see a situation where both risk assets and gold meaningfully appreciate. Primary goal is to hedge against FOMC on Thursday.

Closed my short on IWM 0.00%↑

Closed it at a 3+% profit.

My technical indicators show IWM turning up in the near-term. If the market rallies from here, it’ll be easy to see IWM 0.00%↑ moving up meaningfully

Closed my short on XLF 0.00%↑

Closed it at a 5+% profit

Same reason as IWM, my technicals show XLF turning positive in the near-term. Strong support at 47.30 respected.

Overall good trades. Excited to see them deliver some value.

Trump Trade Chief Pushes for Order After Rocky Tariff Rollout

This is what drove a lot of the gains towards mid-day yesterday.

If the tariffs don’t come in April, the market will see a huge rally

One likely outcome is for USTR to create a formula for a single rate for each country based on that nation’s average tariff level and other measures the Trump team considers discriminatory, according to people familiar with the plans. The rates, though, could be adjusted based on Trump’s perception of whether a country has been cooperative or combative, one of the people said.

There’s also a chance some of the duties don’t take effect in early April, and would only come after a USTR or Commerce Department probe that could drag on for several months, the people said.

Japanese Trading House Shares Rise on Buffett’s Growing Stake

Shares of Mitsubishi Corp., Marubeni Corp., Mitsui & Co., Itochu Corp. and Sumitomo Corp. climbed at least 4% as of 9:09 a.m. in Tokyo after filings to Japan’s finance ministry showed that Berkshire’s average holding across the stocks increased by just over one percentage point to about 9.3%.

Investors had been speculating over Warren Buffett’s next move since his annual letter to shareholders said that Berkshire is looking to increase ownership in Japan’s five largest trading houses “over time”.

Alphabet Said in Talks to Buy Cyber Firm Wiz for $33 Billion

Could be the catalyst for re-rating

Trading at 17.4x forward p/e GOOGL 0.00%↑ is cheap

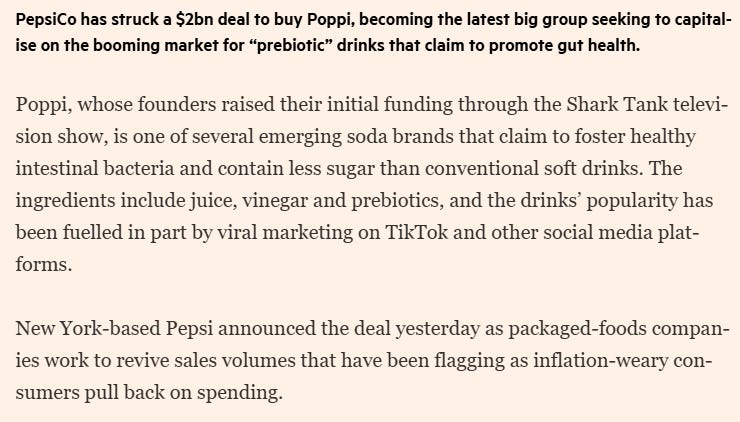

The FTC mentioned on Bloomberg that they want to be more decisive with their legal action, either give the go-ahead or take it to court. The reduced uncertainty should be positive for M&A deals going forward. Probably not a coincidence that GOOGL announced the deal the day after, PEP 0.00%↑ too.

The deal, which may be announced as soon as Tuesday, would be Alphabet’s largest acquisition to date, and could help Alphabet’s Google catch up with Microsoft Corp. and Amazon.com Inc. in the competitive cloud-computing market. The internet search company’s cloud business has been profitable in recent quarters after years of losing money, though its sales growth has slowed.

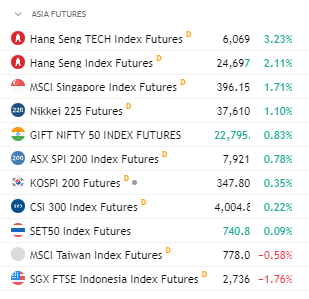

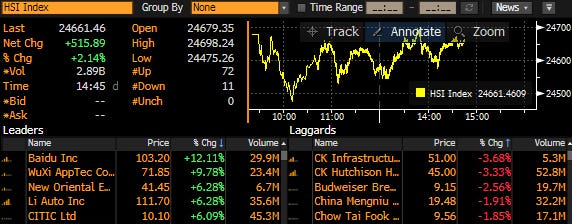

Asia markets looking good after yesterday’s US rally

Strong breadth in HK

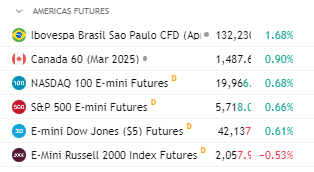

Europe futures edging up too (except Spain)

US futures up except small-caps

USD pausing its decline YTD

If VIX closes below 20, it could signal that the bottom is over

If you believe in seasonalities, Apr should do better than Mar

Light crude continues rallying where I was forced to sell (to fund my delivery of puts sold in SPY 0.00%↑ )

Here’s my full portfolio: