19 Mar 2025

19 Mar 2025

Daily thoughts

Trade recap

What I’m reading

Markets overview

Portfolio review

Let’s look at correlations.

Positive correlation to SPX:

WTI

Negative correlation to SPX:

DXY

10Y yields

Gold

VIX

Credit spreads

My short-term (3-month) view of theses asset classes:

WTI up

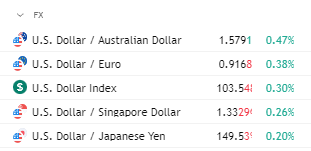

DXY up

10Y down

Gold up

VIX down

Spreads down

Aside from gold and dollar, the indicators point to SPX bullish in the near-term. Only time will tell.

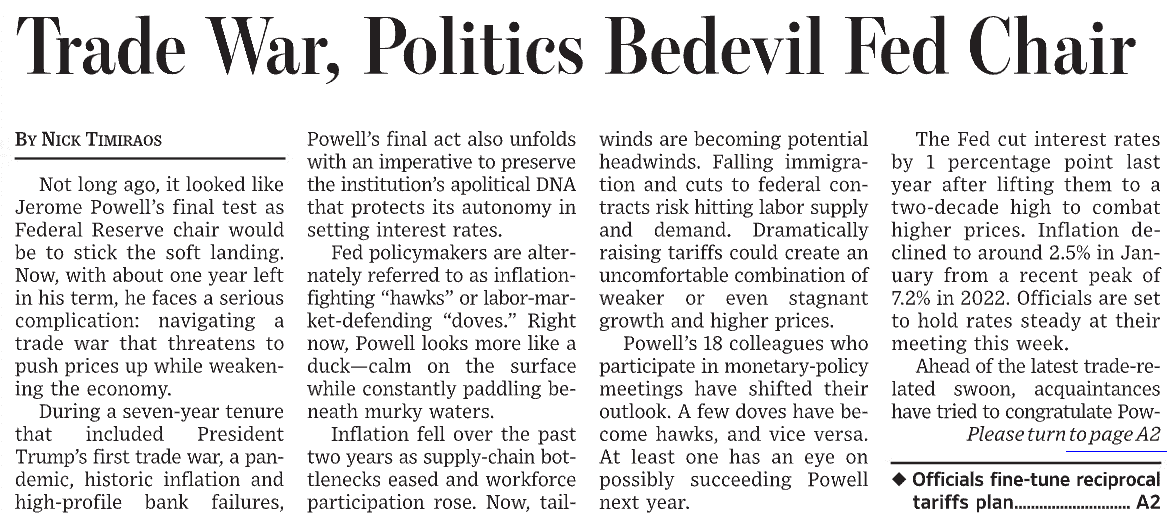

All eyes on FOMC later today. My bet is that as long as the Fed doesn’t spark fear (like suddenly cutting rates, or using cautious wording about the state of the economy), markets should show a slight relief rally.

Sold a bit of volatility yesterday - Dec’26 puts on QQQ 0.00%↑ at 410 strike.

Why? Just following options flow of course :) Futures are pretty flat so I wouldn’t call it a good trade just as yet, but given how high vols are it makes sense to me. Good R/R.

GLD 0.00%↑ bull call spreads doing well, +24%

KWEB 0.00%↑ bull call spreads not doing as well, -15%

UK, EU in Talks to Accelerate Arms for Ukraine Before Ceasefire

“Of course it’s our intention to put Ukraine in the strongest possible position militarily and economically,” the foreign secretary told Bloomberg in an interview before Putin’s call with US President Donald Trump concluded. “We want peace to prevail but we get peace through strength and that means putting Ukraine in the strongest possible position to repel any prospects of the war beginning again.”

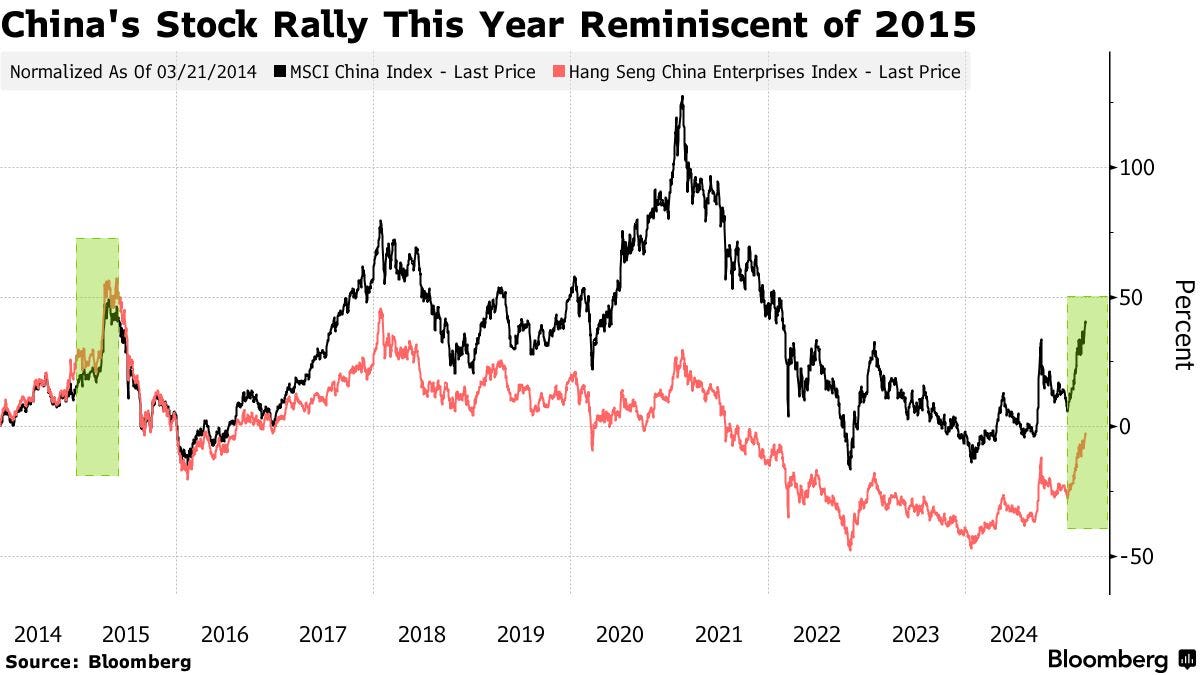

BofA Warns of Chinese Stock Correction ‘Soon’ in 2015 Repeat

The strategists, citing their investor trip to Shanghai, said long-only investors on the mainland are getting nervous as they worry about a lack of improvement in jobs, deflation and credit demand while the impact from geopolitical tensions has been overlooked. Some investors also see bubbles emerging in some tech areas, BofA said.

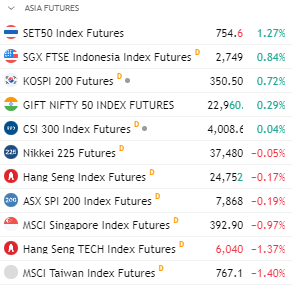

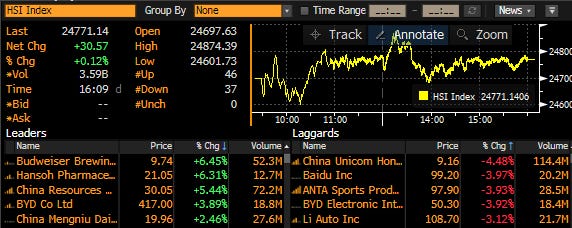

Asia slightly down

Bofa’s warning on a possible correction in Chinese markets scaring investors

HSI nears key support of 25,300

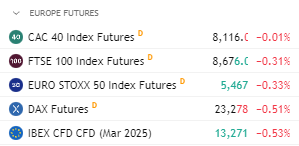

Europe opening red but crawling up slowly

Since this is a rotational market (investors not net selling, but rather rotating from US to other geographies), I think investors selling Asian and European stocks could be sitting on the sidelines for now waiting to deploy into the US on dips (like yesterday)

At the risk of sounding like a perma-bull, my lower support levels for SPX and QQQ are still respected.

US futures up

Dollar up slightly from YTD lows

VIX remains above 20

Here’s my portfolio: