Charts

$DXY Dollar holding on to the weak support at 96.5. I see some near-term upside.

$SPX Futures pulling back 50bps. Potential for some healthy correction, but I remain long.

$NDX Futures also pulling back 50bps. QQQ 0.00%↑ still the relative outperformer vs SPY 0.00%↑. This remains my largest position until my indicators tell me otherwise.

$KOSPI One of the index leaders the past 2 months approaching my sell signals. I give it a 70% chance of turning berarish into a sell signal within the next 10 sessions.

Taiwan still roaring ahead though, looking tempting.

$STOXX Interestingly, European names have lost their shine since Liberation day.

XES 0.00%↑ With all the talk about Iran and oil, O&G equipment names have performing badly. Reminder to self: never trade on headlines alone.

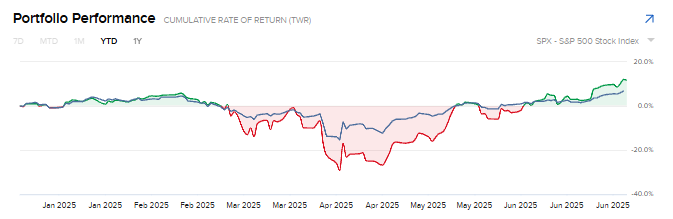

I estimate my current portfolio beta to be ~1.3. If market continues going up, which I anticipate it will, I will continue outperforming. Will turn bearish when my indicators show me it’s time.

Current portfolio: