25 Mar 2025

What to expect for the trading day ahead $SPX

Markets overview

Trade recap

What I’m reading

Portfolio review

Trades today

Markets overview

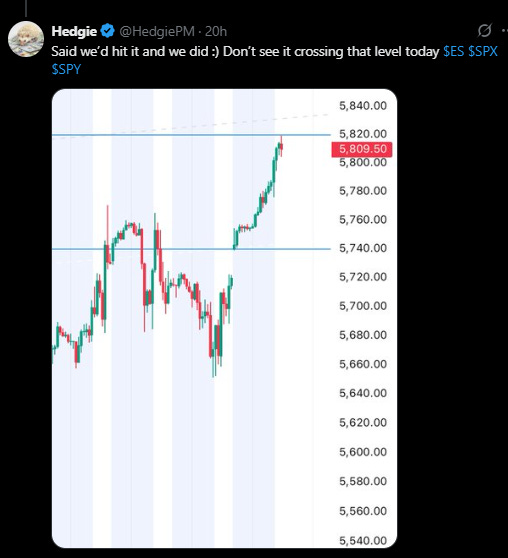

$ES_F future grinding higher as we break above the key level I mentioned yesterday:

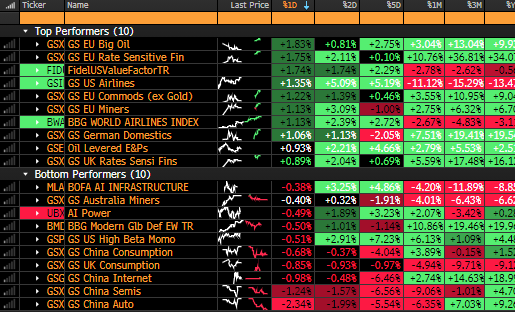

As of 5 minutes into market open we see risk-on sentiment still intact.

My technicals are telling me that the market is a little overextended and we could see a pullback to just below opening levels today. I hope not, but that’s what my short-term technicals are saying. Med to long term i’m still bullish.

My take on today is that we will go higher before bouncing off my key level of 5,8200, before ending the day slightly higher or unchanged.

Semiconductor names are selling-off. Seems like the BABA 0.00%↑ comment on “a bubble in AI data center buildout” is bringing some downside to the market. Any mention of the world “bubble” by the tech companies themselves will undoubtedly draw eyes and selloff.

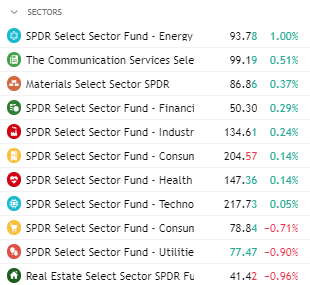

Energy XLE 0.00%↑ leading by a strong margin with XLRE 0.00%↑ lagging as homebuilders have continued to underperform YTD.

Trade recap

As mentioned, I continue to stay long QQQ 0.00%↑ , have cut my long calls on COPX 0.00%↑ , and cut my long put on FEZ 0.00%↑ .

As mentioned in my Substack chat, I’ve initiated the following positions:

Long EWA 0.00%↑. On track and up 86bps so far.

Short $MHG. This has been going against me and will reach my cut loss point soon.

My largest position, and most of my liquid net worth, remains long QQQ 0.00%↑ and has been going well so far today.

What I’m reading

Alibaba’s Tsai Warns of ‘Bubble’ in AI Data Center Buildout

“I start to see the beginning of some kind of bubble,” Tsai told delegates. Some of the envisioned projects commenced raising funds without having secured “uptake” agreements, he added. “I start to get worried when people are building data centers on spec. There are a number of people coming up, funds coming out, to raise billions or millions of capital.”

Australia Unveils Surprise Tax Cuts in Pre-Election Budget

Under the plan, the government will reduce the lowest rate of income tax to 15% in mid-2026 from 16% now, and then to 14% in mid-2027. While the bracket covers incomes from A$18,201 to A$45,000, the relief will flow through to all taxpayers.

Chalmers will also specifically target lower-income households by increasing the threshold at which a levy for the government-run health care system comes into force. This will provide “extra tax relief” for more than a million Australians, he said, with the total cost estimated at more than A$17 billion.

Portfolio review

Here’s my full portfolio: