24 Mar 2025

Are we back for real? Outlook for the market + where do we go from here?

Markets overview

Trade recap

What I’m reading

Portfolio review

Trades today

Markets overview

My conviction that we’ve bottomed has increased significantly based on the price action. The narrative driving the move is a WSJ report that Apr 2 tariffs will be narrowed. ES in pre-market cleared the key level of 5,740, which I can see the market reaching today. The next level to watch is 5,820.

China continues selling-off with no fundamental driver. As I tweeted last week:

Since my tweet, we have been seeing more selling in China. Even today’s news on BABA 0.00%↑ breakthrough with AI chips failed to significantly move the stock.

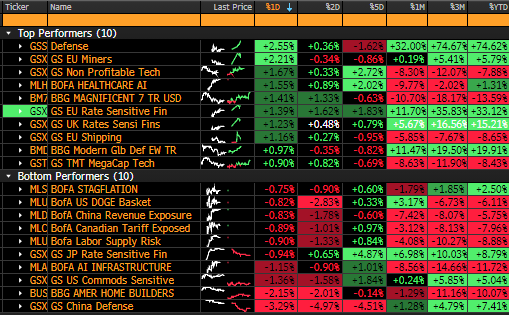

China revenue exposure related names selling-off the most today. Eurozone related stocks rallying. Notably, non-profitable tech, which is a good indicator for risk-on flows, is up 1.67%. I expect more inflows during the US session later on.

Trade recap

Just to recap my weekend post yesterday:

QQQ 0.00%↑

Staying long on QQQ 0.00%↑

TP: 508.50 by Jun

IRR: ~24%

R/R: 1.7x

COPX 0.00%↑

Cutting my Apr calls

I was spot on with the directionality, but I shouldn’t have structured it in a long call option

FEZ 0.00%↑

Close out my short position at market

Missed out on bad execution - put my order to close my short on 28 Feb, but limit px was not hit. Would’ve called the bottom then.

What I’m reading

Indian Stock Rebound Gathers Steam as Nifty Erases Loss for 2025

A number of indicators of economic growth— including tax collections and power demand — have improved in recent weeks, boosting confidence following a selloff in stocks that started in September.

A “cyclical recovery” is underway, driven by a pickup in central government capital expenditure, a reduction in personal income taxes starting April and the central bank’s measures to improve liquidity, Citigroup Inc. analysts wrote in a research note last week.

Indonesian Stocks Pare Loses as New Sovereign Fund Taps Jokowi

Indonesian stocks trimmed losses after the country’s new sovereign wealth fund said two former presidents will be advisors, easing market concerns over its leadership.

The benchmark Jakarta Composite Index closed 1.6% lower Monday, paring a loss of 4.7%, after the announcement. The rupiah lost about 0.3% against the dollar, putting the currency closer to its weakest level since 1998.

Portfolio review

Here’s my full portfolio: