13 Mar 2025

Great interview with Lone Pine

Daily thoughts

Found this interview with Kelly Granat from Lone Pine:

I think about why did I get into this field in the first place I think there's two sort of defining characteristics that I have that positioned me well to to to do this job. One is that I'm a wildly competitive human being. I was a junior tennis player my entire Junior career before going to college I played in college. I love to compete I love a scorecard, that's just who I am as a human. The second is that I'm an incredibly curious person who is very focused on growth, growth in terms of learning about new things, challenging myself. I play instruments, there's lots of things I'm interested in as a human. I feel so lucky to have found a career where I get to actually learn a lot and then put that knowledge to the test by measurement. We can make we can put capital behind those those learnings and those insights and see if we're right because there's a there's a weighing mechanism every day that gives us a scorecard. So for me the opportunity to do that at scale on a topic that is I think transformational not just for the markets but for society is just intoxicating.

We always want some measure of balance in our portfolio and we want several things that we're excited about that have idiosyncratic drivers that some of which may be tied to AI, many of which are not. There are many thematics in our portfolio that we're super excited about and our job is to be thoughtful about portfolio construction and make sure that all of our eggs are not in one basket or things that we we believe are discret bets then ultimately trade like, so that's part of our challenge.

Awesome seeing how someone at her peak of her career remains to passionate and driven. Her eyes really light up when talking about what she’s doing. She gave a fantastic interview with very little marketing.

Flows

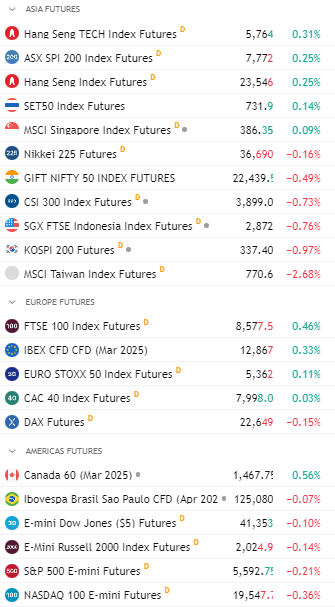

Asia

Leaning bearish during the session. Selling led by tech-related and consumer discretionary names.

Europe

Quite a mixed bag. Idiosyncratic factors are the primary driver for stock movements. Can’t see any specific theme moving the markets.

Novo Nordisk investors buying the dip. I wouldn’t be too eager to buy it…

Halma good results, will do a summary soon.

US

Futures down. Pre-market looks like a mixed bag.

INTC 0.00%↑ up on new CEO appointment

ADBE 0.00%↑ down on 1Q25 results and analyst downgrades

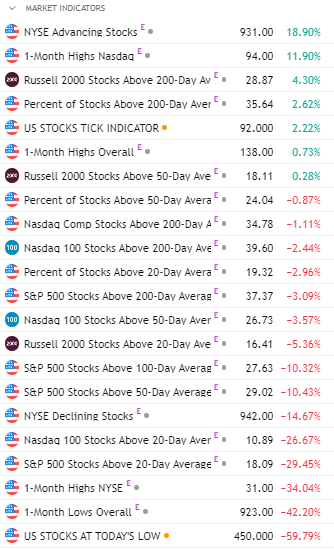

From yesterday’s session, seeing some recovery in breadth - market is still broadly sold off.

Slight bounce for the dollar after the 6% depreciation YTD.

Technicals

Nasdaq futures continue to respect my channel, will remain long until that changes.

XLP 0.00%↑ at key support level of 79.70

XLF 0.00%↑ finding near term support too

Sentiment

Generally negative. No good news for the market to latch on, could explain the negative futures.

Hedge Funds Slash Asia Bets by Most in Four Years, Goldman Says

The Wall Street bank saw the largest decline in hedge fund positions in the region on Monday in four years, it said in the note, without specifying the type of assets.

About 75% of the fall was in developed markets, led by Japan, where hedge funds rushed to cover shorts and sell down long positions, it added. China dominated reduction in emerging markets in Asia, led by hedge funds trimming bullish wagers, it added.

Budweiser APAC to Cut Thousands of Jobs to Reduce Costs by 15%

The latest downsizing is part of the company’s plans to reduce operational costs by about 15% this year and comes after it cut 16% of some 25,000 employees last year, one of the people said. This year’s staff reduction would mean thousands more employees will depart the company after 4,000 were already cut last year, said the people, who asked not to be identified discussing private deliberations.

China will bear the brunt of the reductions as it accounts for more than 80% of the group’s manpower.

The company has been steadily reducing its headcount over the past few years, with the staff size shrinking about 20% by the end of 2023 from more than 30,000 in 2017.

Hong Kong Mulls Lowering Threshold to Buy Most Expensive Stocks

In background meetings between Hong Kong Exchanges & Clearing Ltd. and the brokerage community in recent weeks, bourse officials raised the option of streamlining the minimum trading unit, or board lot, of each stock, the people said, asking not to be named because the matter is private.

Currently the unit is set by each company and can range from 100 shares per trade to thousands. Other markets, including in mainland China, typically trade with a standardized unit of 100 shares and in some cases as low as a single share.

Consumer Angst Is Striking All Income Levels

Take low-income consumers: At an interview at the Economic Club of Chicago in late February, Walmart Chief Executive Doug McMillon said “budget-pressured” customers are showing stressed behaviors: They are buying smaller pack sizes at the end of the month because their “money runs out before the month is gone.” McDonald’s said in its most recent earnings call that the fast-food industry has had a “sluggish start” to the year, in part because of weak demand from low-income consumers. Across the U.S. fast-food industry, sales to low-income guests were down by a double-digit percentage in the fourth quarter compared with a year earlier, according to McDonald’s.

US government closer to shutdown after Senate Democrats oppose bill

Republicans narrowly pushed stop-gap legislation through the House of Representatives on Tuesday night to extend funding at current levels to the end of September.

But Democrats indicated on Wednesday they were unwilling to provide the support needed for the bill — known as a continuing resolution — to pass the Senate before the current funding expires on Friday night.

Tariffs rush some business jet deals, drive aviation cost fears

Makers of private or business jets, such as Canada's Bombardier (BBDb.TO), General Dynamics' (GD.N), Gulfstream Aerospace and Textron (TXT.N), have seen their order backlogs grow on demand from wealthy travelers and corporate clients.

Others are trying to close deals quickly, before further tariffs hit. One European buyer of a U.S. private jet has been trying to rush a transaction, said Katie DeLuca, a partner at Florida-based law firm Harper Meyer.

"That is what I've been seeing in that area, that rush transaction, get it exported, get it into Europe before a potential issue will arise," DeLuca told a Tuesday webinar held by the National Business Aviation Association.