12 Mar 2025

Bouncing back like Ramsay

Daily thoughts

As Gordon Ramsay says:

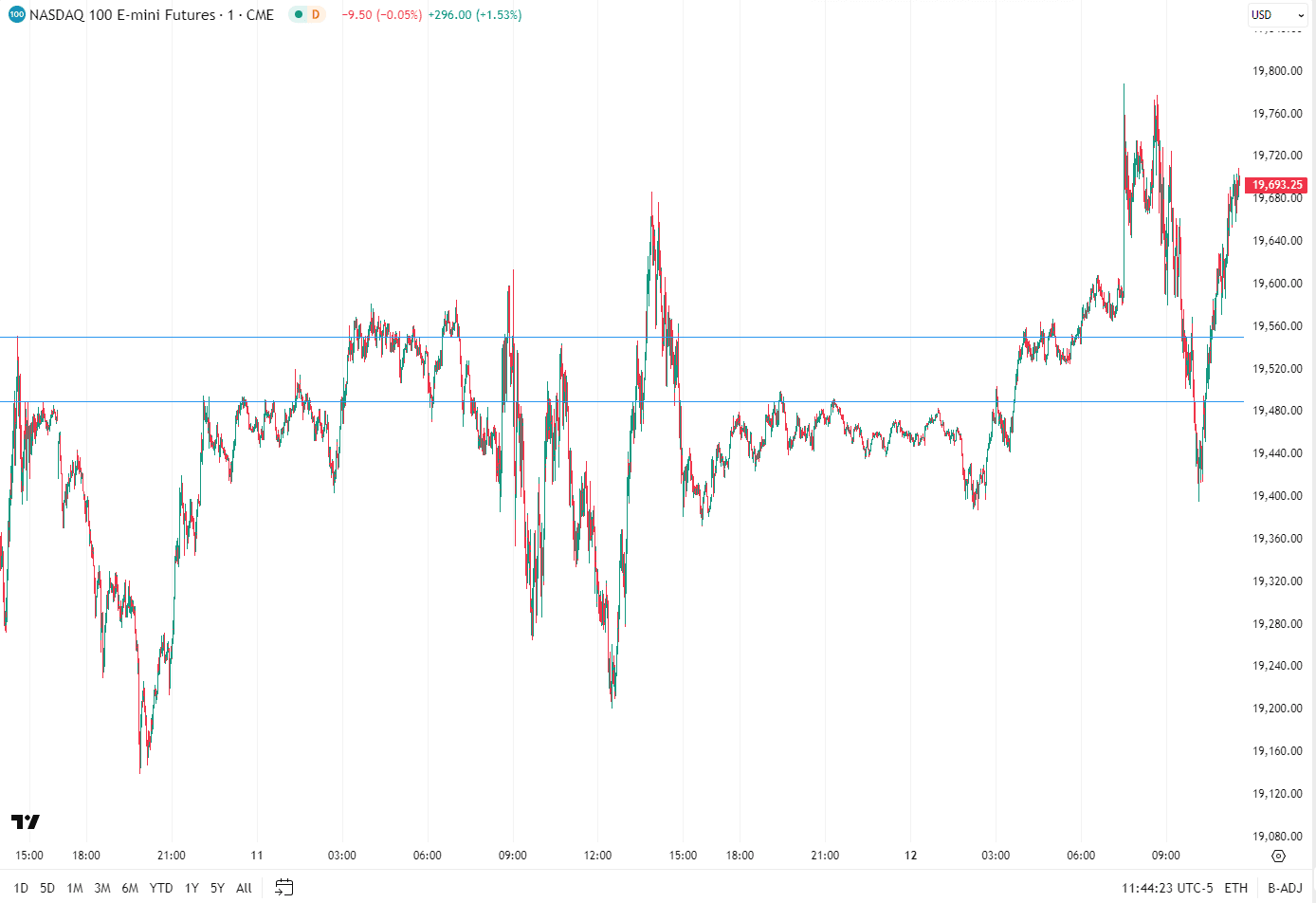

… and the market did

Interestingly, the fintwit consensus seems to say that this bounce is fake. I respectfully disagree, but only time will tell.

Let’s dive right in.

Fundamentals

CPI giving markets some relief amidst tariff pressure. I have no doubt markets would’ve tanked if CPI came in higher than expected. Tariff news at this point mostly priced in. Economy looks strong on all fronts now, I’m not seeing any immediate price hikes or lowered demand. Perhaps that will come in a few months time.

CPI cooler than expected, 0.2% (vs est 0.3%) - very positive as the primary market fear is a recession due to tariff uncertainty.

Both the headline CPI and the core, excluding food and energy costs, rose by 0.2% compared with January, undershooting the median estimates of 0.3% for each. Shelter costs rose 0.3%, almost half of the monthly CPI gain – but a notably smaller rise than seen in recent years.

Year-on-year inflation came in at 2.8% for the headline, down from 3% in January, and 3.1% for the core – down from 3.3% and the slowest pace since April 2021, when the cost-of-living surge began.

Core inflation was propelled by items including medical care, used vehicles, recreation and apparel, while airline fares and new vehicles declined. The drop in airfares added to signs of a downturn in travel demand flagged by carriers in recent days.

Food inflation slowed on the month, to 0.2% from 0.4% in January, even though the price of eggs jumped by 10.4%. On a year-on-year basis, eggs surged by a staggering 58.8%.

Stock futures added to gains after the softer-than-expected inflation print, with S&P 500 contracts up 1.1% at 9:03 a.m. in New York. Treasury yields initially dropped, then retraced the move as investors highlighted the February figures pre-dated likely tariff hikes that may push up prices. Ian Lyngen at BMO said it was the “first time in the cycle in which such a benign inflation print has been completely discounted in favor of other risks.”

25% tariffs on steel and aluminium imports started today - already mostly priced in.

President Donald Trump’s 25% tariffs on steel and aluminum imports came into force today, triggering an immediate reprisal from the EU as the global trade war enters a new and perilous phase. The metals tariffs apply worldwide, with effects extending to economic rivals as well as close US allies. Major Asian producers including South Korea, Taiwan, Japan and Australia held off on retaliating. The UK said it would focus on “rapidly negotiating a wider economic agreement.” China, which wasn’t explicitly targeted in the latest trade salvo, didn’t immediately respond. The European Commission had the strongest reaction so far. It launched “swift and proportionate countermeasures” on US imports, reimposing balancing measures from 2018 and 2020 and adding a new list of industrial and agricultural goods. The EU’s countermeasures will apply to US goods exports worth up to €26 billion — matching the economic scope of the US tariffs, it said.

Technicals

NQ is right at my support level - bounced right off my channel.

Does this mean we’ve bottomed? I’m leaning towards yes. But if it closes decisively below, then we could see a huge downturn, perhaps another 10%.

ES though is a different story, still 5% below my channel. I think long QQQ 0.00%↑ short VOO 0.00%↑ could be a good trade here.

Sentiment

Sentiment is quite jittery on tariffs. Aside from that, generally turning positive (India’s low inflation, Ukraine ceasefire agreement). Main thing dominating sentiment is the easing CPI which placated some sellers.

BOJ Is Said to See Good Reasons to Oppose Bond Market Action

Officials are determined not to step into the market unless extreme moves take place, for fear of creating thresholds for traders that would impact market functioning, according to the people. The market should decide rates and investors need to get used to a world without the central bank’s yield curve control after the program ended last year, they said.

Japan’s benchmark 10-year yields hit 1.575% Monday, the highest level since 2008, while on Wednesday morning the 20-year bond yield also rose to a similar benchmark. The same day, yields on 30-year debt climbed to the highest since 2006.

India’s Below-Target Inflation Boosts Case for Rate Cuts

The consumer price index rose 3.61% in February from a year earlier, the lowest in seven months and below the 3.98% predicted by economists in a Bloomberg survey. Inflation slowed to a seven-month low last month from 4.3% in January.

A slump in food prices helped to drive inflation below the Reserve Bank of India’s 4% target, boosting chances of more rate cuts after new Governor Sanjay Malhotra pivoted to easing in February. The RBI lowered its benchmark rate for the first time in almost five years last month, with economists expecting further reductions in April.

Europe, Canada Hit Back at U.S. Steel Tariffs

Canada said it would put 25% tariffs on an additional $20.6 billion in U.S. imported goods including steel and aluminum products and other American goods such as computers and sports equipment. The Canadian tariffs are set to take effect Thursday.

The EU said it plans 50% tariffs on imports of American whiskey, motorcycles and motorboats starting April 1, hitting some of America’s best-known products including Kentucky bourbon and Harley-Davidson motorcycles. Other goods facing new or raised import duties at the beginning of the month include cranberries, garden umbrellas, tablecloths and handkerchiefs, the bloc said.

Russia pushes back Ukrainian troops after US plan to broker ceasefire

Russian state media shared footage on Wednesday that it said showed Russian soldiers in the centre of Sudzha, the main municipality where Ukraine had set up a command centre.

In February, Zelenskyy insisted the Russian territories held by Ukrainian forces in the Kursk region could be used as a bargaining chip in peace negotiations.

Flows

Interestingly HK and India futures down, US, Europe, China, Japan all up. Moving from high vol to low vol maybe?

Asia

Typical rotation of sell China buy India. Looks like it could be prolonged profit-taking.

Europe

Very strong breadth with substantial dip-buying and some profit-taking.

US

Defensives down: XLV 0.00%↑ XLP 0.00%↑ as well as XLRE 0.00%↑ driven by REITs because of yields up.

Similar to Europe, I see dip buying but with a much narrower breadth, and mostly for NDX names rather than SPX names.