10 Mar 2025

$QQQ historical comparison of performance after candle below 200DMA... surprisingly, not that bad!

Daily thoughts

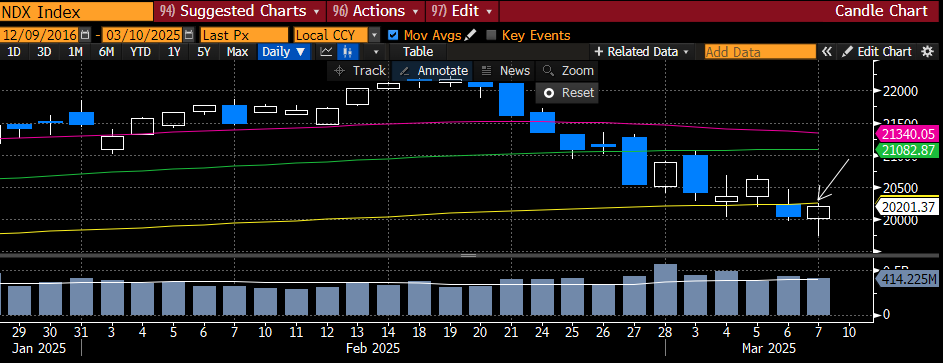

QQQ 0.00%↑ opened at closed below its 200dma. Let’s take a look at how the NDX has historically behaved 20 days after the same thing has happened.

24 Jan 2022: -2.93%

09 Mar 2020: -1.68%

31 May 2019: +7.65%

11 Oct 2018: +2.79%

06 Jan 2016: -6.22%

21 Aug 2015: +3.31%

16 Oct 2014: +11.90%

01 Nov 2012: +1.67%

16 Jun 2011: +7.12%

08 Jun 2010: -3.40%

07 Jan 2008: -9.40%

12 May 2006: -7.00%

07 May 2004: +3.47%

22 May 2000: +19.53%

Periods up/down 8/6

Average up/down +7.18%/-5.11%

Expected value of long 20 days later = (8/14) * (7.18%) + (6/14) * (-5.11%) = 1.92%

Honestly, that’s not a great risk-reward. My conviction has been decreasing in the past 2 sessions.

Futures are also down 47bps.

Historical drawdown of QQQ 0.00%↑ is resting at a key support level.

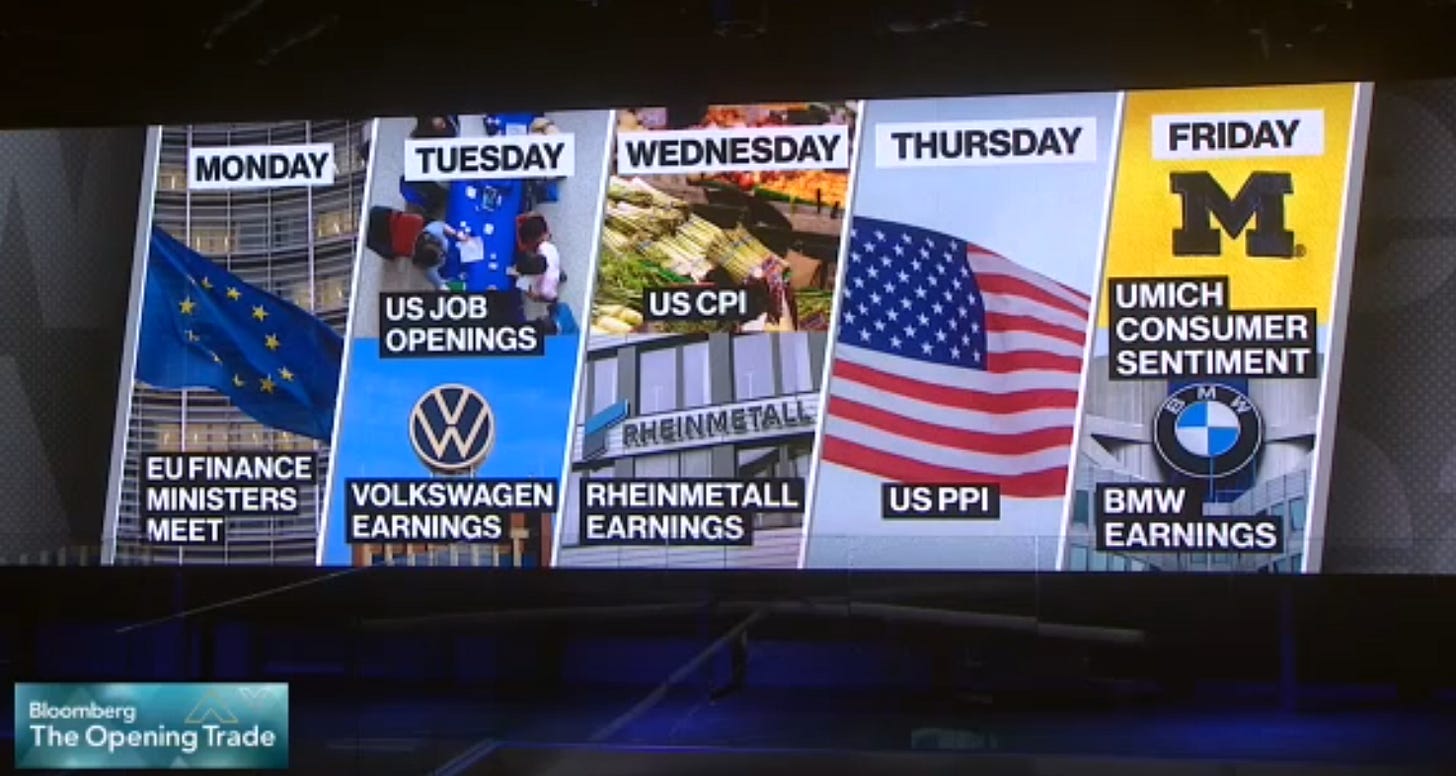

I don’t see many upcoming catalysts this week.

Trade recap

Here’s what I posted last week:"

I remain convicted on my IEFA 0.00%↑ short although it was +1% last Friday. Might add to it today.

What I’m reading

China’s Tariffs on U.S. Agricultural Products Take Effect

The Chinese government announced the tariffs last week, shortly after President Trump raised tariffs on Chinese products for the second time since he took office in January. The Chinese tariffs will include a levy of 15 percent on U.S. products like chicken, wheat and corn, as well as 10 percent on products like soybeans, pork, beef and fruit.

Beijing said that goods that had already been shipped by Monday and imported by April 12 would not be subject to the new tariffs.

China’s Struggles With Supply Glut Threaten to Extend Deflation

Consumer inflation in the year to date has turned negative through January-February for the first time since 2021. While an earlier-than-usual Lunar New Year holiday helped push price growth below zero last month, the downswing was far sharper than predicted, suggesting inflation was feeble even when adjusted for seasonality.

For global banks like Citigroup Inc. and Nomura Holdings Inc., the worry is that consumer prices could hover near contraction territory for the rest of the year if robust production overwhelms demand at home. As the People’s Bank of China prioritizes yuan stability over monetary easing in the near term, dragging the country out of deflation will likely hinge on the ability of policymakers to tackle overcapacity.

Deliveroo Exits Hong Kong Under Pressure From Rival Meituan App

The London-based delivery company will sell some assets to rival Foodpanda, owned by Delivery Hero SE, and close other assets, it said in a statement on Monday.

Deliveroo has faced stiff competition and price wars in Hong Kong from Foodpanda and KeeTa, a subsidiary of Chinese food delivery giant Meituan. Success in China has let Meituan expand aggressively, with growing operations across Asia and the Middle East. It typically enters markets with low prices and steep discounts, a strategy it can keep thanks to a soaring share price.

TSMC’s Sales Quicken in First Two Months in Upbeat Note for AI

Taiwan Semiconductor Manufacturing Co.’s revenue climbed 39% in the first two months, quickening from 2024 in a sign of resilient demand for the Nvidia Corp. chips that power AI development.

The world’s largest chipmaker reported combined revenue for the first two months of NT$553.3 billion ($16.8 billion). That compares with 34% growth during the full-year of 2024. Analysts on average are projecting growth of about 41% this quarter.

Mark Carney to replace Justin Trudeau as Canada’s prime minister

The incoming prime minister said his government would find new trading relationships with “reliable partners” and vowed to maintain retaliatory tariffs on the US “until the Americans show us respect”, he said.

In the end, the race for party leadership was not close. Carney won with 131,674 votes, or 86 per cent, ahead of Trudeau’s former finance minister Chrystia Freeland with 11,134.

Carney said the party would pursue fiscal responsibility and social justice while striving to unite Canada. “My pledge to you and all Canadians is to build a stronger Canada for everyone,” he said.

The end of cheap palm oil? Output stalls as biodiesel demand surges

Even in Indonesia, replanting by smallholders, who generate 40% of its supply, remains sluggish.

As a result, global production growth has slowed to 1% annually over the past four years.

In the current decade, production growth is likely to average 1.3 million tons a year, said analyst Thomas Mielke, executive director of Hamburg-based forecaster Oil World, less than half the average of 2.9 million in the decade to 2020.

Production could lose even more momentum from the impact of labour shortages, ageing plantations and the spread of Ganoderma fungus, which is hurting yields, Mielke said.

Markets update

Asia

Seeing broad selling across Asia, looks like a combination of profit-taking from recent strength, as well as uncertainties from China’s trade tariffs on the US.

Europe

Looking very overbought, many names are signalling sell on my indicators.

Overall market looks overstretched; narrative of Germany debt overplayed and will disappear in a few sessions.

Will be looking to short.

US

Pretty much the opposite of Europe - many names looking oversold. Yes, tariffs and geopolitical uncertainty are real but some of the selling has been overdone.

This differs from the big drawdown in 2022, where many names did not flag out as oversold on my indicators.

Macro

DXY continues weakening but finding some weak support at 103.50.

10Y yields look like a potential turning point here, I can see yields higher 3 months from now.

Pecking order: US (long), Asia (neutral), Europe (short)