07 Mar 2025

Survived the brutal sell-off. Just gotta stick to the process and keep Doing the Thing.

Daily thoughts

Recap of yesterday’s trades

What I’m reading

Markets overview

Portfolio review

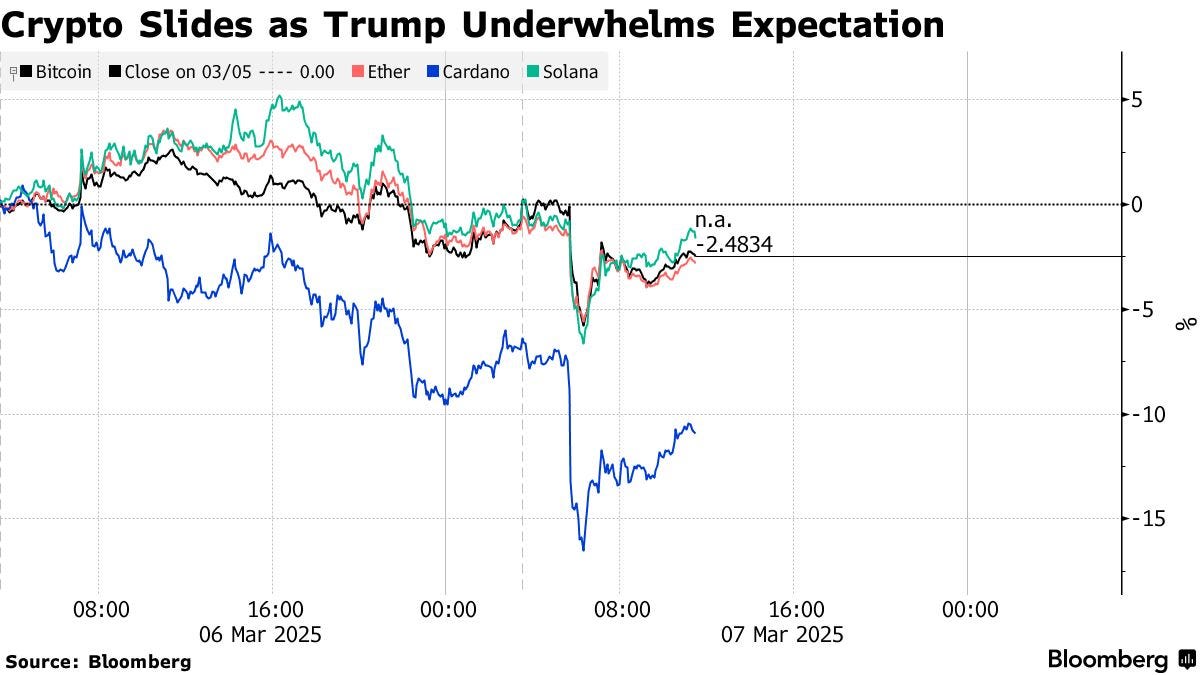

Trades for today

Preparing to do the thing isn't doing the thing.

Scheduling time to do the thing isn't doing the thing.

Making a to-do list for the thing isn't doing the thing.

Telling people you're going to do the thing isn't doing the thing.

Messaging friends who may or may not be doing the thing isn't doing the thing.

Writing a banger tweet about how you're going to do the thing isn't doing the thing.

Hating on yourself for not doing the thing isn't doing the thing. Hating on other people who have done the thing isn't doing the thing. Hating on the obstacles in the way of doing the thing isn't doing the thing.

Fantasizing about all of the adoration you'll receive once you do the thing isn't doing the thing.

Reading about how to do the thing isn't doing the thing. Reading about how other people did the thing isn't doing the thing. Reading this essay isn't doing the thing.

The only thing that is doing the thing is doing the thing.

/

What a brutal sell-off yesterday. NDX opened below the 200dMA, SPX supported by it.

As Druckenmiller said:

“Probably one of my greatest assets over the last 30 years is that I’m open-minded and I can change my mind very quickly.”

I resonate with this a lot. I am the same, there’s no shame in admitting you were wrong and moving on. I, too, will always change my mind so please do not take my words as investment advice.

Have I changed my mind about being bullish equities? No, and my portfolio is still positioned for that trade. But my conviction has decreased from ~90% to ~60%. Today’s session will be key. If NDX sees a another down day like yesterday, I can see myself moving to the short side.

Let’s see. Rest assured I’ll keep you updated here and on X.

Here’s what I posted yesterday in the trades section:

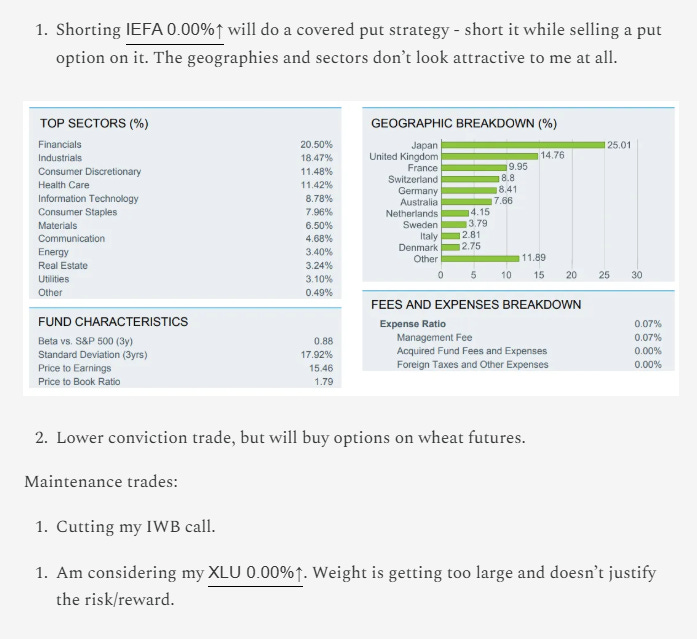

I did short IEFA 0.00%↑ at 77.94, small position at ~3ppt of my port. Positive trade, I was surprised that the market sold off so much though. This was not that great a trade because it sold-off less than QQQ 0.00%↑ , but a win is a win.

I also did buy options on wheat futures, not a positive trade as wheat is down almost 1% from yesterday.

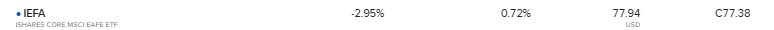

Fundamentally though I think it’s a great trade. People are concerned about tariffs increasing inflation. Federal Reserve Bank of Philadelphia President Patrick Harker said yesterday that’ he’s concerned about the Fed’s 2% target:

The Philadelphia Fed chief said it’s still his base case for inflation to move slowly down to the central bank’s 2% target, but he is growing more concerned that the decline in price growth “is at risk.”

“I’m not saying it’s not going to happen,” Harker said Thursday during an event with educators at the Philadelphia Fed. “But it seems like there’s a lot of pressures building where that might not be the case.”

Historically, if you look at commodities (white line) vs CPI (blue line), they move hand-in-hand. Commodities lead by a few months but the zoomed-out trend is clear.

I will continue holding this, perhaps even add more if it holds above my support level.

Maintenance trades - cutting XLU and IWB call. Good trade as well, the whole market came down. Although I didn’t get hits on my IWB call sell. Will queue again today.

All-in-all, good trades yesterday.

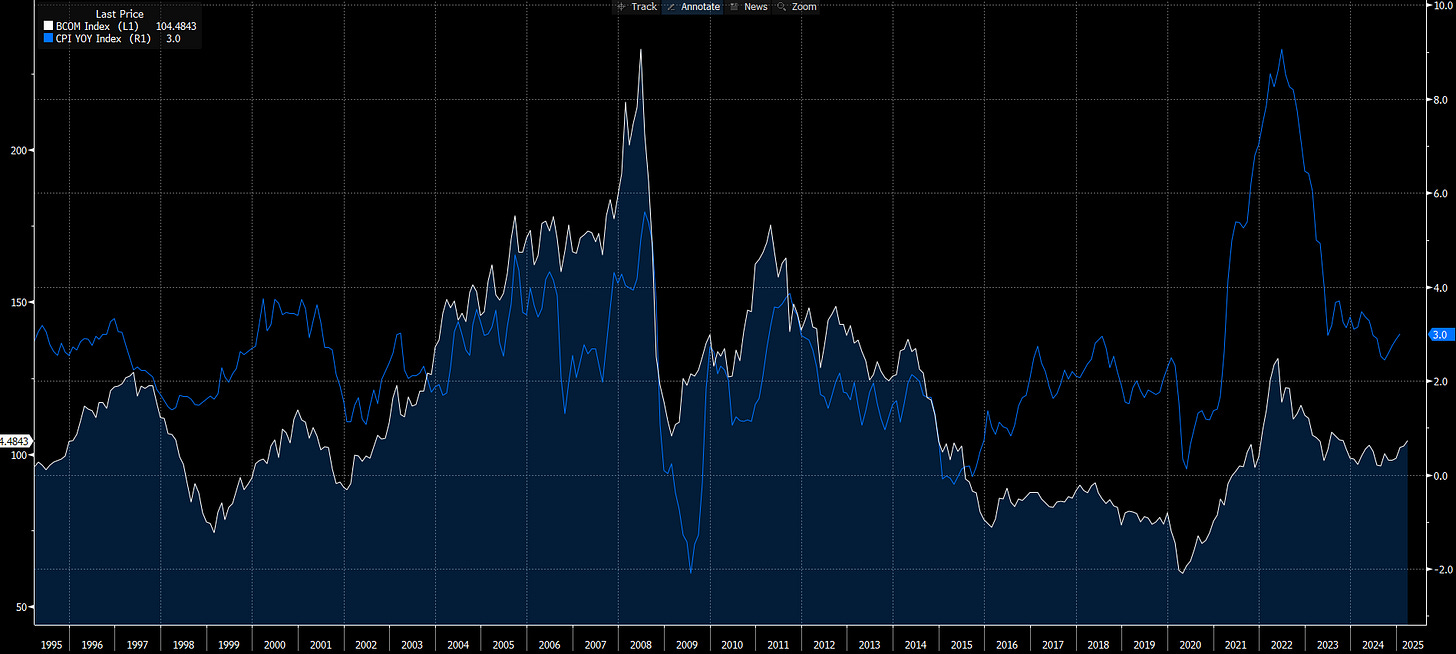

Bitcoin Drops After Trump Executive Order Disappoints Market

The order, shared initially as a post on X by White House crypto czar David Sacks, indicated that the government wouldn’t use taxpayer money to fund a strategic reserve of the largest digital asset.

Instead, the reserve would be capitalized with Bitcoin already owned by the federal government. Any further acquisitions would require “budget-neutral strategies for acquiring additional Bitcoin, provided that those strategies impose no incremental costs on American taxpayers,” the order said.

Nor will the US sell Bitcoin deposited into the reserve, according to the order.

Big Chunk of North American Trade Remains Exposed to Tariffs

The analytics firm Trade Partnership Worldwide estimated that in 2024, 50% of Mexican exports and 38% of Canadian exports entered the U.S. duty-free under USMCA. These products include cars, trucks and auto parts from either country. Also falling under this category are Canadian rapeseed oils, chocolates, beef and engines; and Mexican television sets, air conditioners, avocados and tomatoes.

About 40% of U.S. imports from Canada and Mexico fell outside USMCA but still passed through duty-free: The U.S. imposes no tariffs on a host of products, regardless of the supplier country.

From Mexico, such products included computers, medical equipment, phones and beer. From Canada, such products included petroleum gases, aluminum, airplanes and turbojet engines.

US to begin negotiations with Ukraine

“The war must be stopped as soon as possible, and Ukraine is ready to work 24/7 together with partners in America and Europe for peace,” Zelenskyy said on a post on Telegram after the Brussels summit.

“Next week, on Monday, I am scheduled to visit Saudi Arabia to meet with the Crown Prince [Mohammed bin Salman]. After that, my team will remain in Saudi Arabia to work with American partners. Ukraine is most interested in peace.”

Global coffee trade grinding to a halt, hit hard by brutal price hikes

Renan Chueiri, director general at ELCAFE C.A. in Ecuador, said this year is the first time the instant coffee maker hasn't sold all of its expected annual production by March.

"We would usually be sold out by now, but so far we sold less than 30% of production," he said. "The big price increase eats clients' cash flow, they don't have all the money to buy what they need."

The coffee price hikes have stemmed from lower production in important coffee growing regions, particularly in top grower Brazil, reducing the availability of beans.

Asia

Mixed bag. Chinese domestic-focused names did well. I find it really strange that tech names sold-off post JD’s stellar earnings. Perhaps a follow-through from the US session? There are still names strongly up so that gives me some comfort.

Europe

Mostly down, led by discretionary spending. Industrials leading the way up. I think the only bull story is Germany’s infrastructure spending push. Hard to see a compelling risk/reward in other sectors.

US

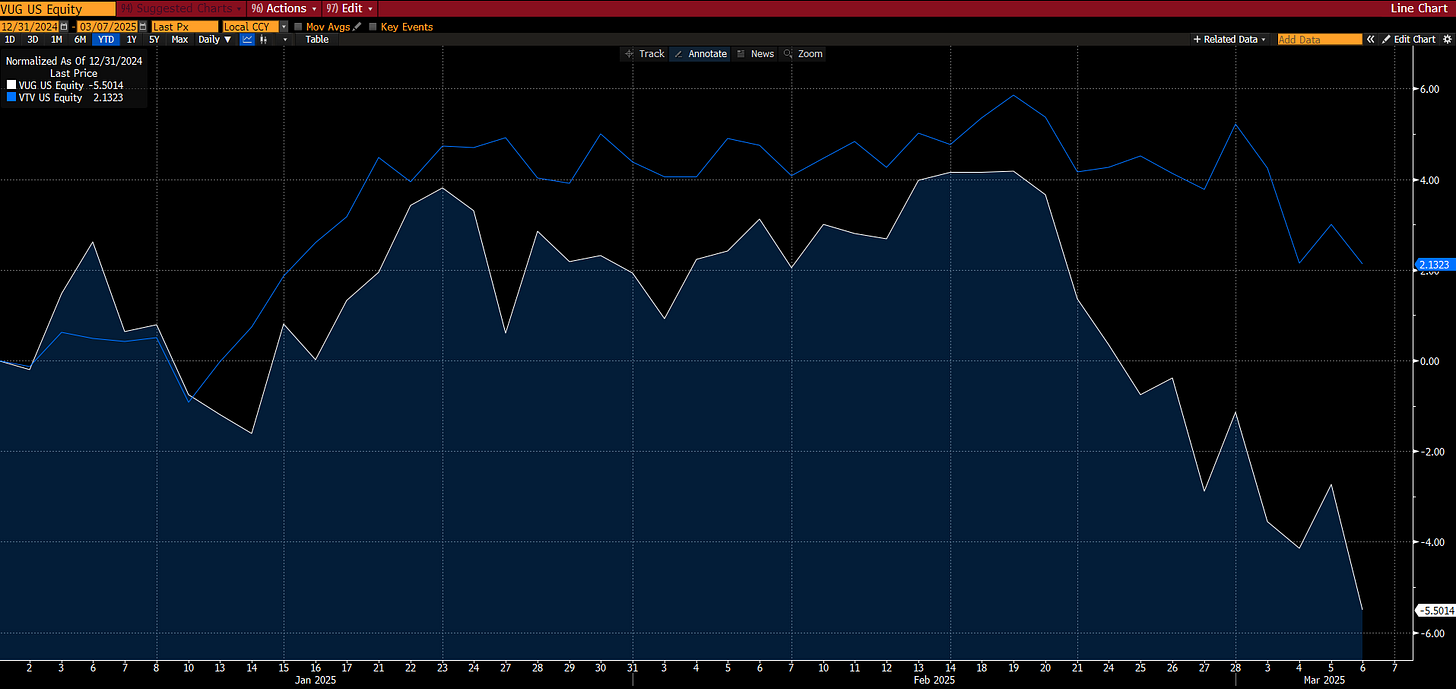

Tech, real estate (data centers), discretionary, utilities led the drop yesterday. Interestingly, names that were still up on the day are names that have declined significantly the past few months. YTD value names are +2.1% while growth names are -5.5%. That’s a 7.6% spread.

Macro

DXY continues grinding lower, VIX continues grinding higher - does not bode well for stocks.

Crude +1.3% on the day.

10Y yields seem directionless at 4.27%. Am still biased towards lower rates on Trump and Bessent’s strong view that rates should be lower.

Portfolio review: yesterday was not great for my port.