06 Mar 2025

How much is your attention worth? $43k per year.

Daily thoughts

Recap of yesterday’s trades

What I’m reading

Markets overview

Portfolio review

Trades for today

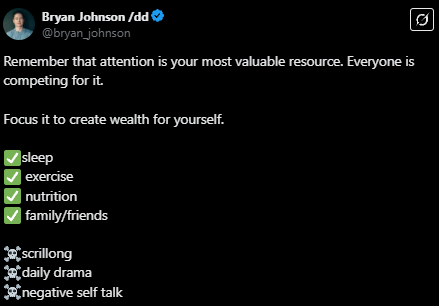

Saw this tweet by Bryan Johnson:

I wondered… how much is your attention really worth?

From Shopify:

The average CPM for Facebook ads in November 2024 was $13.75.

That means each impression would cost 1.375 cents. Let’s assume each impression lasts a full second. That amounts to 82.5 cents per minute. That’s $49.50 per hour.

Statista says the average daily time spent on social media per user is 143 minutes. Per day. That amounts to 82.50 cents x 143 minutes = $117.975 per day. That’s $43,060.87 per year. That’s how much your attention is worth.

Really puts doom-scrolling into perspective, doesn't it?

Yesterday was a great day. Here’s what I mentioned in my post yesterday:

Bought HSTECH options today - fundamentals of China’s govt stimulus announced about 7 hours ago, markets not fully pricing that in yet.

Crude - looking to enter some ATM options for crude, probably a 1ppt play.

Generally still bullish on equities - I’m expecting a higher close today.

Let’s take a look:

HSTECH call - doing very well. HSTECH ended the day at 6,068.77 HKD. So I’m very much ITM for this one.

Crude - also doing very well for now. Betting that the bottom stays supported. Fundamentally, the only positive seems to be Russia continuing to make cuts to production, below OPEC’s quota. Technically, seems like it’s oversold.

Bullish on equities - I added a risk reversal which I posted on

TwitterI mean X:In trading, with the right risk management, you don’t expect to get all calls right. I got all my calls right. I guess this is the best time to say…

China Officials Say Nation Has 'Ample' Policy Tools as Tariffs Weigh

PBOC will choose timing this year to reduce rates, RRR

Plans start-up guidance fund, support for big tech firms to sell bonds

Finance ministry has ‘ample’ policy tools, space for uncertainty

China to unveil special campaign to boost consumption soon

The Recession Trade Is Back on Wall Street

Losses have been particularly acute in sectors that investors view as sensitive to a slowdown, such as banks and smaller companies. The tech-heavy Nasdaq Composite has fallen 7.5% since mid-February. Oil prices have slipped. Havens including gold and U.S. Treasurys, meanwhile, have rallied.

“I think a lot of people were just assuming that tariffs was just a bluff, and now there’s more uncertainty around that,” said Keith Lerner, co-chief investment officer at Truist Advisory Services.

White House Grants One-Month Tariff Exemption for Automakers

Automakers will get a one-month reprieve from tariffs on Mexico and Canada for cars that comply with a free-trade agreement between those two nations and the U.S., the White House said Wednesday.

The move follows a request from the heads of Ford Motor, General Motors and Stellantis, White House press secretary Karoline Leavitt said, and would apply to autos imported through the U.S.-Mexico-Canada Agreement, or USMCA, the successor trade deal to 1994’s North American Free Trade Agreement.

Global bond sell-off deepens as Germany jolts markets

A global bond sell-off deepened on Thursday as investors reeled from a historic slump in Germany’s debt market following a political agreement in Berlin on a fiscal package that is expected to boost the Eurozone’s largest economy.

The yield on the 10-year Bund climbed 0.14 percentage points to 2.92 per cent in early trading on Thursday, following the steepest rise in almost 30 years on Wednesday. Yields on French and Italian debt also jumped.

Germany’s ‘whatever-it-takes’ spending push to end years of stagnation

While details still need to be fleshed out, the historic deal between the chancellor-in-waiting and his likely coalition partners, the centre-left Social Democrats, allows for potentially unlimited borrowing for defence spending and creates a €500bn 10-year fund to drive infrastructure investments.

The plan also breaks with more than two decades of fiscal conservatism, and puts government spending on track to surge at a pace not seen since the fall of the Wall in 1989, with economists at Hamburg Commercial Bank anticipating a rise in the debt-to-GDP level from 63 to 84 per cent.

Asia

Throw a stone and you’ll hit an outperforming stock. Asia bulls are back. Broad and strong flows into most asian names. (the screenshot is not indicative because it’s showing after hours in Asia)

Europe

Mixed bag. Winners led by autos given Trump’s 1-month exemption for tariffs on automakers.

Also driven by Germany (see news above)

US

Pre-market looking very weak led by tech.

Macro

Dollar continues going lower… I think another 2% down for the DXY before it finds some support.

VIX back up to 23.40 - not bullish.

The German bunds decline is driving the treasury selloff. Treasuries continue declining, so you’re seeing selling in stocks AND bonds. Investors selling US stocks and bonds to buy Asia and Europe? That seems to be the rotation today.

Gold is surprisingly down too.

Outperforming SPX by 210bps YTD. Am still biased towards being bullish on equities. Let’s see if QQQ 0.00%↑ continues a third straight session of opening lower and closing much higher.

Here’s my full portfolio: