05 Mar 2025

Did you buy the dip yesterday?

Recap of yesterday’s trades

What I’m reading

Markets overview

Portfolio review

Trades for tomorrow

Starting with a pat on the back for myself, bear with me.

So I posted yesterday about 3 trades I did. Here’s how they fared yesterday on what seemed like doom and gloom:

QQQ 0.00%↑ - slightly down, but holding my support level very well

Long XLU 0.00%↑ short XLF 0.00%↑ - up +1.9% on this pair yesterday

Closed my short on FEZ 0.00%↑ - FEZ up 2% since I closed it

On top of that, I doubled down on QQQ 0.00%↑ during the session, and my short put was up 8% at the end of the session.

China Sets GDP Target at About 5% Despite Trump Tariffs

China set a bullish economic growth goal of around 5% this year. Fiscal deficit target set at around 4% of GDP, highest in over three decades. Beijing lowers CPI target to around 2% for first time in more than 20 years. Boosting domestic demand made top priority as Trump imposes tariffs.

All eyes are on tomorrow 3pm, when People’s Bank of China governor Pan Gongsheng, Finance Minister Lan Fo’an and China Securities Regulatory Commission Chairman Wu Qing will brief the media.

Trump doubled down on tariffs, called to end the war in Ukraine, and praised Elon Musk’s cost-cutting agenda. He called on Congress to approve more funding for his deportation campaign and undo the CHIPS Act.

MS TMT conference day 2: Management teams are aware of the volatility, but they’re not seeing it impact them yet. A lot of talk about AI benefits for customers, and increasing efficiency in their own business.

MS consumer survey shows a drop in consumer sentiment and first negative reading since Jun 2024, driven by tariff fears and political divide.

UBS estimates that 25% tariffs on Canada and Mexico will lower GDP growth by 0.8% this year. With rising unemployment, fed fund rates should be lower by 2027.

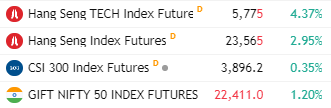

Asia

Very strong markets, though interestingly CSI300 only +0.4%. HSTECH though is +4.4% which I will discuss later below.

Europe

Largest gains at the open come from a rebound in auto names. Perhaps some dip buying which seems unsustainable.

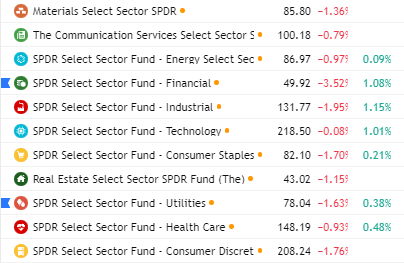

US

Pre-marking looking strong too with dip buying all around - names that fell the most are up the most.

Macro

Dollar weakening, with rates coming up - market selling bonds to buy equities.

Crude looks very interesting here, at a key support level.

Keep reading with a 7-day free trial

Subscribe to Hedgie's notes to keep reading this post and get 7 days of free access to the full post archives.